Are $1,000 Stimulus Checks Coming in 2025?

As of February 2025, discussions about $1,000 stimulus checks are widespread. However, it’s crucial to separate facts from rumors and understand who might be eligible for payments, how they are distributed, and what steps you need to take to claim any available funds.

Are There New $1,000 Stimulus Checks in February 2025?

There is no new federal $1,000 stimulus check approved for February 2025. However, the IRS is distributing payments to individuals who missed out on the Recovery Rebate Credit from 2021. To ensure you receive any funds due, make sure you have filed your 2021 tax return. Additionally, certain states have introduced their own financial relief programs, so it’s important to stay informed.

Key Details About Stimulus Payments in 2025

| Topic | Details |

|---|---|

| Stimulus Amount | Up to $1,400 per eligible individual |

| Eligibility Criteria | Individuals who did not claim the Recovery Rebate Credit on their 2021 tax returns |

| Payment Distribution | Began in December 2024 and continued through January 2025 |

| Payment Methods | Direct deposit or paper check |

| Action Required | No action required for identified individuals; others must file a 2021 tax return by April 15, 2025 |

Understanding the Current Stimulus Payments

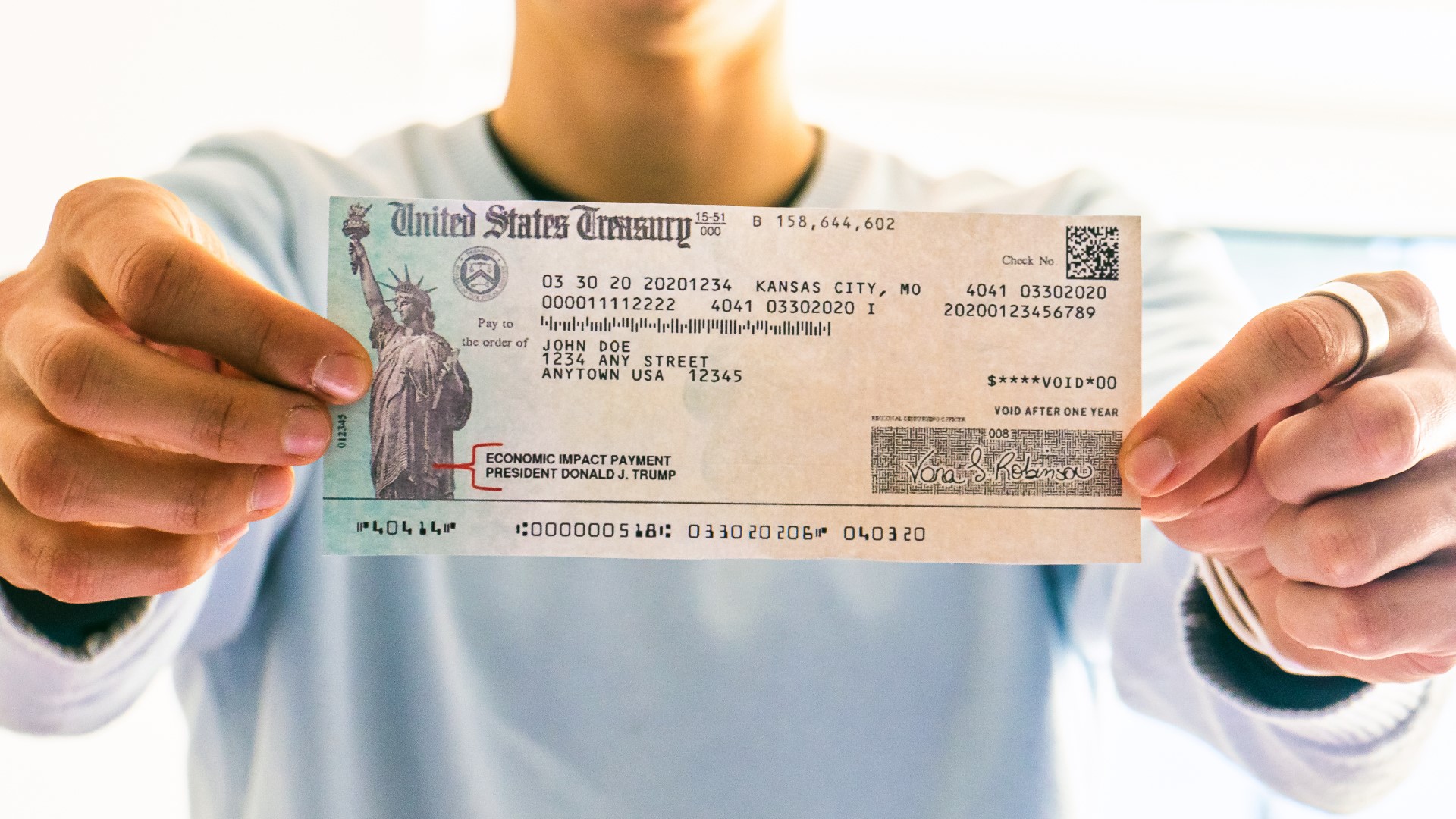

In December 2024, the IRS announced automatic payments of up to $1,400 for about one million taxpayers. These payments are designated for individuals who qualified for the Recovery Rebate Credit but didn’t claim it when filing their 2021 taxes.

What Is the Recovery Rebate Credit?

The Recovery Rebate Credit was introduced as part of federal COVID-19 relief efforts. If you did not receive the full amount of the third Economic Impact Payment in 2021, you might still be eligible to claim this credit by filing your 2021 tax return.

Who Is Eligible for These Payments?

To determine eligibility, consider the following factors:

- Tax Return Status: You must have filed a 2021 tax return but either left the Recovery Rebate Credit field blank or entered $0, despite being eligible.

- Income Limits:

- Single filers: AGI below $80,000

- Married filing jointly: AGI below $160,000

- Heads of household: AGI below $120,000

- Dependency Status: You should not be claimed as a dependent on someone else’s return.

If you meet these criteria, the IRS has likely identified you for an automatic payment.

Payment Distribution Details

- Timeline: Payments started in December 2024, with most recipients receiving their funds by late January 2025.

- Method: Payments are being issued via direct deposit (to the bank account linked to your 2023 tax return) or by paper check (sent to your last known address).

- Action Required: If the IRS has identified you as eligible, no action is needed. You should have received a notification letter from the IRS detailing the payment.

Haven’t Filed Your 2021 Tax Return Yet? Act Now!

If you have not yet filed your 2021 tax return, there’s still time to claim the Recovery Rebate Credit. The deadline to file and receive this payment is April 15, 2025. Even if you had minimal or no income in 2021, filing could make you eligible for the credit.

Watch Out for Stimulus Scams

With rumors about stimulus checks circulating, be extra cautious of scams. The IRS will never contact you via phone, email, or social media to request personal information or payments. To avoid fraud:

- Only refer to official IRS communications.

- Do not click on unsolicited links.

- Never share personal details with unverified sources.

State-Specific Stimulus Programs

While there is no new federal stimulus check, some states are offering financial relief:

- Pennsylvania: Provides financial aid through the Property Tax/Rent Rebate Program, with payments up to $1,000.

- New Mexico: Issues $1,000 payments to eligible residents to offset inflation.

Eligibility and application requirements vary by state. To check for state-specific programs, visit your state’s official website or contact local government offices.

Related Financial Assistance

Aside from stimulus checks, eligible individuals may qualify for other financial relief options, such as:

- $675 stimulus checks – Eligibility varies by income and state regulations.

- $2,000 tax credits – Available for qualifying individuals based on IRS guidelines.

- Supplemental Security Income (SSI) – Payments may vary month to month.

Can I Receive an IRS Stimulus Check in 2025?

Whether you receive an IRS stimulus check depends on your income level and filing status:

- Single filers earning $14,600 or more must file a tax return.

- Heads of household earning $21,900 or more are required to file.

- Married couples filing jointly must file if their income exceeds $29,200 (or $30,750 if only one spouse is under 65).

If you have low income, you may still qualify for a Tax Refund through tax credits and deductions. However, it’s important not to rely on a stimulus check as part of your financial planning.

Need Help? Consult a Tax Specialist

If you’re unsure about your eligibility or need assistance filing your taxes, it’s always best to consult a professional. A tax expert can help you determine whether you qualify for a stimulus payment or tax credit and ensure that you file correctly.